Branching out to a greener bank

So, hands up who wants to talk about banking! Probably no one, or at least no one with any sense. Because, let’s face it, it is just so…boring. In fact, just writing that first sentence made me feel sleepy.

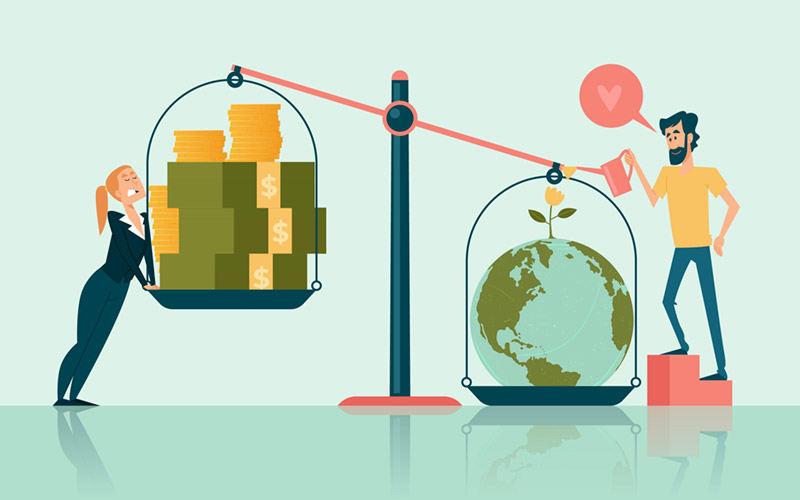

Nevertheless, I urge you to try and stay awake, and to keep reading. Because when it comes to reducing our personal environmental impact, switching your account from a bank that invests in fossil fuels to a greener, more ethical alternative is one of the best things you can do.

Let’s take a quick look at some numbers. (Stop yawning at the back there!) A study in 2023 showed that, since the signing of the Paris Agreement at the United Nations in 2015 (whereby world leaders committed to work to keep global warming within certain limits), the financial services industry had invested over $5.5 trillion in fossil fuels – the stuff the Paris Agreement was trying to stop.

That’s over $5,500,000,000,000. That’s one big number. A whole lotta zeroes. I know it can be hard for our brains to actually process this kind of number. So, for context – it’s nearly as much as Elon Musk lost down the back of his sofa last year.

UK banks figured highly in all this, with the Big/Filthy Five – Barclays, HSBC, Santander, Lloyds and NatWest – leading the charge. Top of the roll of shame was Barclays, the worst in Europe at $235bn, closely followed by HSBC at $192bn. Lloyds – who are closing their branch in Lewes at the start of next year – chipped in just under $22bn. This may sound like small beer compared to the other two, but it’s still an awful lot of carbon.

And yet, despite this, very few people switch banks. Data suggests you’re more likely to leave your life partner. What’s the reason for this phenomenon? Well, friends, I will attempt to demonstrate by telling you a shameful tale.

I joined Barclays at university because they had a stall at my freshers fair and were giving away some nice pens. (It was a simpler world back then.) And then I stayed with them for years. Decades, indeed. I didn’t consider switching, because, well, why would I? The bank was just the place I went to withdraw my money. It never crossed my mind what they might actually be doing with the money.

Gradually, I became aware. Eventually, back in around 2017, I started getting involved in activism against the financial sector. Barclays was always a prime target. I attended anti-Barclays demos, got involved in street theatre, wrote a film script, participated in online actions. And during all that time…I remained a Barclays customer.

Yes, friends, I’m afraid so. I make no excuses. I knew that as a consumer, the most powerful thing I could do was to vote with my feet. That there were ethical banks out there. That it’s easy to switch.

And yet… somehow I just never seemed to get around to it. It was always something I’d do ‘tomorrow.’ A deep and abiding source of shame.

And then, one fine day, I finally did it. And it felt great! I’m not a financial adviser, so I won’t tell you who I switched to, but I will say that it was incredibly easy (thanks largely to the Current Account Switch Guarantee introduced 12 years ago – see below). My new bank’s service levels are streets ahead of Barclays. And best of all, when I opened my wallet, I no longer have that card staring at me like the eye of Sauron.

So please. If you haven’t already, do the same. Visit Bank Green or Switchit to see what ethical banks are out there. And do it now. Don’t faff around. Don’t be like me.

What is the Current Account Switch Guarantee?

The Current Account Switch Guarantee is a free service launched in 2013 that guarantees a smooth, secure, and simple switch from one current account to another, completed in seven working days. The guarantee includes the automatic transfer of all payments, such as direct debits and salaries, to your new account, and redirects any payments made to your old account to the new one.

It also protects you from any charges or interest incurred if there are any issues with the switch.

Find out more at www.currentaccountswitch.co.uk